As cryptocurrency adoption grows globally, understanding crypto money laundering techniques and major cases becomes essential for compliance professionals, law enforcement, and financial institutions. Our analysis of the top six cryptocurrency money laundering cases provides crucial insights into how criminals exploit digital assets and what measures can be taken to prevent future incidents.

While cryptocurrencies like Bitcoin and Ethereum have revolutionised finance with their security, decentralisation, and ease of movement, these same features have also made them attractive to criminals. The result has been a surge in cryptocurrency money laundering (often referred to as simply crypto money laundering) activities, with billions of dollars stolen through hacks, Ponzi schemes, and mixing services, among others.

According to Chainalysis’ 2025 Crypto Crime Report, illicit cryptocurrency addresses received $40.9 billion in 2024 (£30.6 billion) — a record — though the true figure is estimated to be closer to $51 billion (£38.1 billion), underscoring the growing scale of crypto crime. But how do criminals exploit cryptocurrencies, and what can be done to stop them?

In this blog, we explore six of the most high-profile crypto money laundering cases, including Bitfinex, Plus Token, and Silk Road. We’ll also examine how these major crimes have impacted the wider crypto market and what they reveal about the evolving landscape of digital financial crime. Whether you’re an investor, regulator, or simply curious about crypto, understanding these cases is crucial to navigating the risks and opportunities of digital assets.

What is Cryptocurrency Money Laundering?

Cryptocurrency money laundering follows the same pattern used for fiat (government-issued) currencies by “cleaning” funds gained through illicit means, before exchanging or withdrawing them for cash. The tokens are moved through various digital addresses to obscure their illegal origin and make them more difficult to trace.

The appeal of cryptocurrency for money laundering lies in several key characteristics that differ from traditional banking systems. Unlike conventional bank transfers that require extensive documentation and can be easily frozen by authorities, cryptocurrency transactions can be initiated with minimal identity verification. Additionally, the decentralised nature of blockchain networks means there’s no central authority that can immediately halt suspicious transactions, giving criminals valuable time to move funds through multiple addresses before detection.

Cryptocurrency and Money Laundering: How Does it Work?

Thanks to their privacy-preserving nature, cryptocurrencies have become popular vehicles to conceal the true origins of illicitly-gained funds. Cybercriminals will utilise a variety of methods and services to funnel these assets through several businesses or online addresses in order to hide the money trail, before transferring them to an ostensibly legitimate source. From here, they can be converted into cash.

There are several methods that criminals will use when engaging in cryptocurrency money laundering, including:

- Smurfing: Splitting up large sums of money into smaller amounts so they can be sent via multiple transactions.

- Exchange Hopping: Using multiple cryptocurrency exchanges to transfer funds across several platforms and obscure the money trail.

- Offshore Transactions: Creating offshore accounts to hide the origin of funds.

- Mixing: Blending together the crypto assets of multiple users, making it difficult to determine who owns what.

- Gambling Platforms: Depositing tokens into online gambling websites to be either withdrawn as cash or used to place coordinated bets.

To find out more about crypto money laundering and the techniques involved, check out our blog on the subject.

6 Notable Cryptocurrency Money Laundering Cases

Now that we’ve delved into the inner-workings of cryptocurrency money laundering, it’s time to explore some of the biggest crypto money laundering cases that have taken place in recent years — with some examples having had a huge knock-on effect on the entire crypto market.

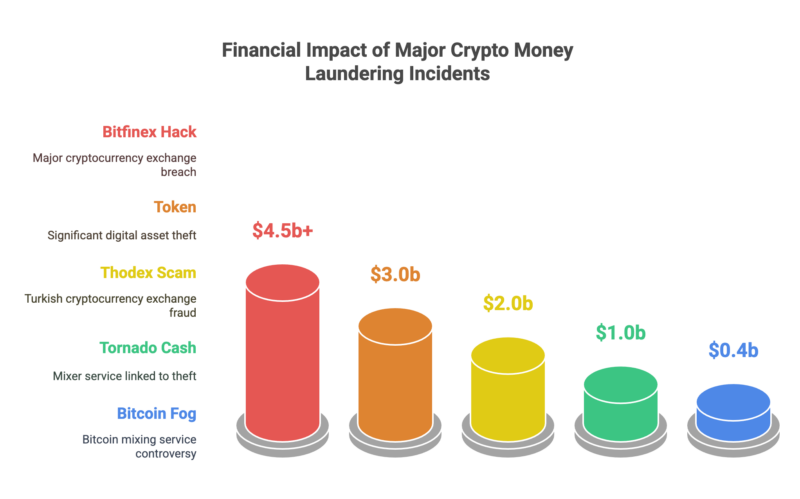

Hacking of Bitfinex

One of the largest hacks of all time occurred when the Bitfinex cryptocurrency exchange was hacked in August 2016, with fraudsters making off with 120,000 Bitcoins — worth billions of dollars. According to the US Department of Justice (DOJ), two people were arrested for conspiracy to launder $4.5 billion in stolen tokens relating to the hack.

The couple, Ilya Lichtenstein and Heather Morgan were accused of Bitcoin laundering by using a “labyrinth of transactions” and setting up online accounts with a number of exchanges under false identities. They also used the “chain hopping” technique, which involves swapping the funds between various cryptocurrencies to muddy the paper trail.

Plus Token

Targeting people in China and Korea, the Plus Token Ponzi scheme promised investors lucrative returns of between 9% and 18% via what turned out to be a fake programme. The scheme eventually collapsed in 2019, but not before the perpetrators had managed to walk away with almost $3 billion worth of Bitcoin.

Such was the scale of the fraud that the scheme was, at least for a time, attributed to a drop in the overall price of Bitcoin. In July 2020, over 100 people were arrested for their part in the activity, with the main parties sentenced for up to 11 years.

Thodex

Turkey’s Thodex cryptocurrency trading website abruptly shut down in April 2021, locking almost 400,000 users out of the service. Its CEO, Faruk Fatih Özer, made off with $2 billion worth of digital tokens — with the scam affecting people from all walks of life.

The sudden closure of Thodex had a large impact on Turkey’s economy, with ordinary citizens being caught up in the aftermath. Because the country’s fiat currency (the Lira) was losing value and prices were rising, many people decided to safeguard their money through cryptocurrencies — a lot of which was subsequently lost as a result of this scam.

Tornado Cash

A cryptocurrency mixing service, Tornado Cash was used by fraudsters to obscure the trail of funds from their criminal origins. It was even favoured by a sanctioned North Korean cybercrime organisation known as Lazarus Group to launder their stolen funds.

According to the US DOJ, the co-founders of Tornado Cash were charged with crypto money laundering and the violation of certain sanctions. Roman Storm and Roman Semenov were accused in August 2023 of knowingly facilitating more than $1 billion of illegal activity, while publicly claiming to offer a legitimate privacy service.

Silk Road

Once known as the “Amazon of illegal goods”, Silk Road became hugely popular after its launch in February 2011. At one point, the website accounted for over 20% of Bitcoin’s daily trading — highlighting how important the digital token was to illegal online trade.

Two years after it was founded, Silk Road’s founder, Ross Ulbricht, was arrested and charged with multiple offences including cryptocurrency money laundering and arranging murders. The arrest even had a short-term impact on Bitcoin’s value, with the price dropping from $140 to $110 before summarily recovering.

Bitcoin Fog

Said to be the longest-running Bitcoin laundering service in the world, Bitcoin Fog is alleged to have handled around $400 million worth of transactions between 2011 and 2021. Much like Tornado Cash, the website was a cryptocurrency mixer that enabled users to move over 1.2 million of the digital tokens during its 10-year lifespan. Its operator, Roman Sterlingov, was convicted in March 2024.

2025 Cryptocurrency Landscape: What Every Investor Should Know

The cryptocurrency world has changed dramatically in 2025, and these shifts directly impact your safety as a prospective investor. Understanding current trends in money laundering and regulatory changes helps you spot red flags and protects your investments from fraud.

Current Threats Every Crypto Investor Faces

Stablecoins: The New Fraud Favorite

Criminals have shifted from Bitcoin to stablecoins like Tether (USDT) for their schemes in 2025. Why should you care? Because:

- Fraudulent projects increasingly use stablecoins to appear more legitimate.

- Scammers can move your stolen funds faster and with less detection.

- Recovery becomes nearly impossible once funds enter stablecoin networks.

Warning Signs: Be extra cautious of investment opportunities that only accept stablecoins, promise unusually high returns in USDT, or pressure you to convert Bitcoin to stablecoins.

Cross-Border Scam Operations

According to the EU’s Anti-Money Laundering Authority (AMLA), crypto’s cross-border nature makes it the “top emerging threat” for money laundering. This affects you because:

- Scammers easily operate across multiple countries to avoid prosecution.

- Your funds can disappear into jurisdictions where recovery is impossible.

- Fake exchanges can relocate overnight when authorities close in.

Red Flags: Investment platforms registered in multiple countries, unclear jurisdictional information, or constantly changing business addresses should raise immediate concerns.

Compliance Gaps You Can Exploit for Protection

Major crypto platforms can operate with tiny compliance teams — Tether reportedly has only a handful of investigators for millions of accounts. This creates risks but also opportunities:

- Risk: Suspicious activity on platforms may go undetected longer.

- Opportunity: You can often spot fraudulent patterns before platforms do.

- Protection: Choose exchanges with robust compliance reputations over convenience.

2025 Regulatory Changes and What They Mean for Your Safety

Europe Gets Tougher (Good News for Investors)

The EU’s new Anti-Money Laundering Authority (AMLA) launched in July 2025 with aggressive expansion plans — scaling from 30 to over 400 employees by 2028. For investors, this means:

- European exchanges face much stricter oversight.

- Better protection against fraudulent projects based in the EU.

- Increased chances of fund recovery in European jurisdictions.

What to Do: Consider prioritising EU-regulated exchanges and platforms for better investor protection.

United States Takes Lighter Approach (Mixed Results)

The Trump administration’s crypto-friendly stance has reduced enforcement pressure but created new risks:

- Major platforms like Tether have moved offshore to avoid oversight.

- Fewer regulatory protections for U.S. investors.

- Increased “regulatory arbitrage” where companies shop for lenient jurisdictions.

What to Watch: Be extra cautious of platforms that have recently relocated from the U.S. to offshore locations — they may be avoiding stricter oversights that protect you.

Global Enforcement Still Improving

Despite regulatory differences, international cooperation on crypto crime continues strengthening:

- Better blockchain tracking tools help recover stolen funds.

- More successful prosecutions of major crypto criminals.

- Improved coordination between countries on cross-border crimes.

Prevention and Detection: Essential Strategies for the Future

With crypto-related money laundering becoming increasingly sophisticated, staying ahead requires more than basic compliance. Businesses must focus on real-time transaction monitoring, robust KYC procedures, and the use of advanced blockchain analytics to spot red flags — such as unusual patterns, links to high-risk jurisdictions, or mixing services.

Staff training and clear reporting processes are equally vital, ensuring your team can respond quickly to suspicious behaviour and regulatory obligations. This is particularly true if you operate in a potentially high-risk industry such as a crypto exchanges, online gambling, or a digital asset investment firm.

The right technology — particularly AI-driven monitoring tools which are continuing to grow more sophisticated by the week — can make all the difference in flagging high-risk activity before damage is done.

For help identifying threats and responding effectively, explore our guides:

- Crypto Wallet Hacked? 8-Step Emergency Recovery Protocol

- Cryptocurrency Scams UK: A Guide to Spotting Fraud

Specialist Support with Cryptocurrency Crime

Having already established itself as a leading name in “traditional” financial fraud defence and forensic accounting investigations, the team at Inquesta Forensic stands ready to assist with all manner of cryptocurrency crime, including cryptocurrency money laundering. We have the skills needed to navigate through the complex nature of crypto transactions and provide a thorough assessment of your case.

Whether you’ve been a victim of cryptocurrency fraud, or have been accused of carrying out offences, our team will work tirelessly to protect your interests. We can help at every stage, from conducting an investigation right through to appearing as an expert witness in court, wherever necessary. Get in touch today to find out more.

Disclaimer: This blog is for informational purposes only and does not constitute legal advice. Always consult with a professional for specific advice related to your situation.

- Your Partner’s Been Convicted: Can They Take Your House? What Section 10a POCA Means For You

- The Essential Role of Forensic Accounting in High Net Worth Divorce

- How to Value a Startup Business: A Guide for UK Entrepreneurs

- Pig Butchering Scams: Guide to Crypto Romance Fraud

- Shareholders’ Disputes: How Business Valuation Helps with Shareholder Dispute Resolution