Financial crime prosecution presents some of the most complex challenges in modern law. To prove financial crime in court requires much more than just legal expertise — it demands a meticulous approach to evidence gathering, financial analysis, and strategic preparation of the most comprehensive case possible.

From sophisticated fraud schemes to cross-border money laundering and the incorporation of digital currency such as cryptocurrency, today’s financial crimes exploit highly sophisticated, ever-evolving, systems, techniques, and technologies. The key question isn’t simply what classes as financial crime, but rather how to effectively present these complex cases when it matters most — in the courtroom.

This guide provides solicitors with a tactical roadmap for navigating the evidence-based challenges unique to financial crime cases, leveraging forensic accountant financial crime expertise to strengthen your position, anticipating and overcoming common defence strategies, ensuring compliance with POCA, and more.

Whatever your situation requires, understanding these critical elements could ultimately determine the outcome. Read on to find out more:

What Classes as Financial Crime?

What classes as financial crime is a broad question to ask as it can encompass a wide variety of illegal activities. Financial crime refers to any illegal act that involves the use of financial systems in order to gain an economic benefit. It will typically involve some form of theft, deception, or manipulation.

Financial crime can be committed by an individual, a business, or an organised group of offenders.

Common offences that can class as financial crime are:

- Fraud

- Money Laundering

- Bribery

- Corruption

- Insider Trading

- Tax Evasion

- Embezzlement

In the UK, financial crimes fall under various legal frameworks, including the Proceeds of Crime Act (POCA) 2002 and the Fraud Act 2006.

Legal Considerations When Proving Financial Crime

The process of prosecuting financial crime requires a thorough understanding of the relevant laws and regulations. Considerations that include:

- Evidential Requirements: It is the role of the prosecution to establish that the defendant engaged in activities that would constitute as a financial crime. This will involve presenting clear and compelling evidence that meets the standard of proof beyond a reasonable doubt while withstanding any potential scrutiny.

- Admissibility of Evidence: Ensure that all evidence collected complies with legal standards, making it admissible in court. This requires ensuring that proper procedure is followed at all times during investigation.

- Expert Testimony: A forensic accountant may be called upon to provide their expert testimony and explain some of the more complex financial data involved in the investigation. They will also be expected to present their findings to the court in a clearly understandable manner.

Real Life Example: The Tesco Accounting Scandal

A notable example of forensic accounting assisting with proving financial crime in court was the 2014 Tesco Accounting Scandal. Forensic accountants were able to uncover key evidence which stated that Tesco executives were artificially inflating company profits by overstating income and understating costs.

This pattern of inaccurate financial reporting was reported to have taken place across several years, affecting share prices and allowing the executives to benefit from higher bonuses due to their perceived ‘success’.

This scandal led to significant legal ramifications for those involved, including costs up to £235million in order to settle investigations by the Financial Conduct Authority — further highlighting the importance forensic accounting can have if you’re looking to detect misconduct and prove financial crime in court.

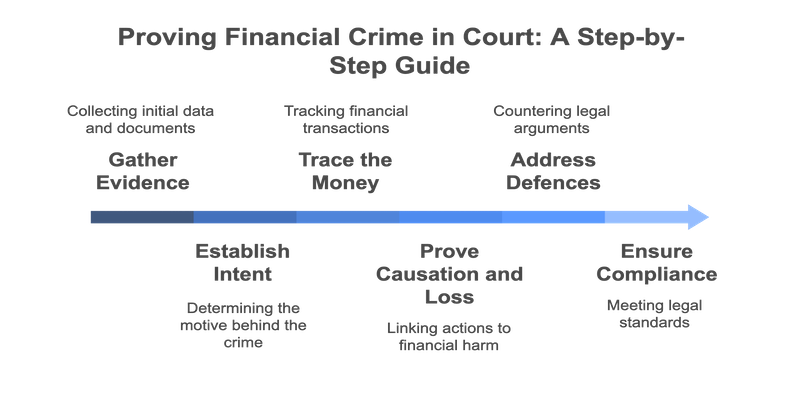

Key Steps to Proving Financial Crime in Court

Successfully proving financial crime in court requires a structured approach, leaving zero room for doubt. Each stage of the process — from gathering evidence through addressing potential defences — plays a crucial role in building a strong case. This section outlines the essential steps solicitors and forensic accountants should follow to present compelling arguments and secure successful outcomes.

1. Gather Evidence

The foundation of a successful prosecution should always be rooted in presenting solid evidence. In cases of financial crime, this typically involves collecting and analysing vast arrays of financial documents and data, such as:

- Bank statements to help trace the flow of funds.

- Invoices and receipts to verify transactions.

- Tax returns to identify potential discrepancies.

- Emails/communications to look for intent or evidence of collusion.

2. Establish Intent

Always one of the most complex aspects when looking to prove financial crime in court, establishing intent is particularly difficult, as it will involve difficult to decipher transactions.

Proving intent requires an ability to demonstrate that the accused knowingly engaged in illegal activity. This can be achieved via:

- Documentary Evidence: Emails, internal reports, virtual messages, or anything else that would indicate knowledge of the crimes.

- Witness Testimony: By speaking to colleagues, employees, or other parties close to the accused, who may be able to attest to their actions and intentions.

- Patterns of Behaviour: Previous attempts to conceal transactions or a history that indicate a pattern of attempts to defraud others could be considered.

3. Trace the Money

Tracing the money trail when attempting to prove financial crime in court will involve identifying the source of illicit funds, determining how they were moved, and where they might have ended up. Forensic accountants will be able to utilise various techniques to trace funds and support your case, including:

- Analysing Bank Records: Bank statements can be reviewed to identify any suspicious or unusual transactions.

- Asset Tracing: Assets that were purchased using illicit funds may be identified.

- Blockchain Analysis: In cases involving cryptocurrency, expert analysis of blockchain transactions can help to trace the flow of funds, despite the complexities involved.

Following a trail of money will not only help in establishing the true extent of the crime, but it can also provide key evidence which can be utilised to help secure convictions and recover assets.

4. Prove Causation and Loss

In cases of serious financial crime, it’s vital that you are able to prove that the actions of the accused directly cause financial loss or harm. This will require a clear causal link between the illegality and the resulting damage caused. Solicitors looking to prove financial crime in court must demonstrate the following:

- Signs that the accused’s actions did directly lead to financial loss.

- The amount of money/the value of assets that was lost as a result of the crime.

Forensic accountants can assist in quantifying these losses by way of thorough analysis of financial records and data, assessment of the value of assets, and offering testimony as an expert witness.

5. Address Defences

Some of the most common defences in cases of financial crime include that the:

- Accused acted without intent

- Accused was not aware of the illegal activity

- Evidence is not sufficient to prove guilt.

It is the responsibility of the Prosecution to counter these arguments. This is done by creating and implementing an effective strategy, including:

- Anticipate Defence: You should try to prepare counterarguments for the likely defences.

- Challenge Evidence: By scrutinising the defence’s evidence, you may be able to highlight areas of weakness or inconsistency.

- Reinforce the Case: It’s important to do what you can to emphasise the strength of the evidence and the credibility of expert testimony.

6. Ensure Compliance

To successfully prove financial crime in court leading to a prosecution, strict adherence to legal standards and procedures is required. Solicitors must ensure that all evidence has been obtained legally and that the rights of the accused are protected throughout the process.

Any failure to comply with these standards can result in key evidence being excluded or, in some instances, the case being dismissed altogether.

Challenges in Proving Financial Crime

Needing to prove financial crime in court presents several significant challenges due to the complexity and sophistication of modern criminal tactics. From intricate financial transactions to cross-border jurisdictional hurdles, legal professionals must navigate a constantly evolving landscape. Understanding these challenges is crucial to building a robust case and successfully prosecuting financial wrongdoing.

Some of the common challenges in proving financial crime include:

- Complexity of Financial Transactions: A key challenge with financial crimes often involves the intricate schemes and transactions used by the criminals. Such methods are designed specifically to obscure illicit activities as much as possible and make it challenging to trace the flow of funds.

- Jurisdiction Issues: Many financial crimes will involve an international element. This further complicates the process of tracing funds as it requires coordination between different jurisdictions and navigating varying legal systems/regulations.

- Evolving Methods: As technology continues to advance, the methods utilised to commit these financial crimes also evolves. Staying ahead of the ever-shifting tactics utilised by criminals requires continuous learning and adaptation.

Best Practices for Solicitors

Successfully proving financial crime requires a strategic and methodical approach. By adopting best practices — such as engaging forensic accountants early, maintaining thorough documentation, and collaborating with regulatory agencies — solicitors can strengthen their cases. These measures not only enhance the integrity of evidence but also significantly improve the chances of a favourable outcome in court.

- Engage Forensic Accountant Early: The sooner you involve an expert forensic accountant in your investigation, the more thorough their investigation and assessment processes can be. This can significantly strengthen the case by ensuring financial evidence is most accurately identified, preserved, and analysed.

- Maintain Comprehensive Documentation: Highly detailed records of communications, investigate steps undertaken, and financial transactions all contribute to supporting the integrity of your evidence and help to present a cohesive narrative in court.

- Ensure Compliance with Legal Protocols: Full adherence to legal standards when collecting evidence and investigating is key if you wish to prevent challenges.

- Prepare for Expert Testimony: Anticipate the need for potential expert witnesses, such as a forensic accountants, who can explain highly complex financial evidence clearly and effectively to the court.

The Role of a Forensic Accountant in Financial Crime Investigations

A forensic accountant is vital in financial crime investigations when looking to prove financial crime in court. Their expertise lies in the analysis of financial data in order to uncover potential irregularities as well as signs of fraudulent activities. Forensic accountants routinely work closely with solicitors, regulatory bodies, and even law enforcement agencies in order to gather and interpret complicated financial evidence.

Beyond merely crunching numbers though, forensic accountants act as expert interpreters of financial data and narratives. They are often relied upon to translate complex data into compelling legal evidence.

Key Forensic Accounting Techniques

- Financial Statement Analysis: By scrutinising financial statements, you can often identify areas of inconsistency, unusual patterns, or suspicious transactions that require further investigation. Forensic accountants will compare past and present data in order to detect anomalies that could be an indication of fraudulent activities or financial mismanagement.

- Asset Tracing: Crucial in cases where offenders have attempted to conceal or launder proceeds derived from criminality, forensic accountants boast extensive experience in the effective identification and tracking of hidden assets.

- Data Mining and Digital Forensics: By utilising advanced software and analytical tools, a forensic accountant can detect patterns within large datasets that could be lost when conducting manual analysis due to the sheer volume of data.

- Lifestyle Analysis: Comparing an individual’s known income source with their actual lifestyle and outgoings can help in identifying areas of financial discrepancies indicative of illicit income.

Proving Financial Crime: Why Expert Forensic Support is Essential

The process to prove financial crime in court remains one of the most demanding tasks for legal professionals, and the difference between failure and success very often lies in the quality of financial evidence and the interpretation of it.

For solicitors handling these high-stakes cases, there are three non-negotiable elements:

- Irrefutable financial evidence that can withstand scrutiny.

- Clear demonstration of intent through patterns of transactions and communication history.

- Credible expert testimony to better translate complex data into compelling arguments.

At Inquesta Forensic, we specialise in taking complex and intricate financial data and transforming it into courtroom-ready evidence that supports your case. We provide solicitors with:

- Investigations that trace funds and identify any possible irregularities.

- Expert witness support to present findings with clarity and authority.

In financial crime cases, time is critical. The sooner you engage a forensic accountant, the better your position will be. Contact Inquesta Forensic today to discuss how we can support your case and help you prove financial crime in court.

- How to Value a Startup Business: A Guide for UK Entrepreneurs

- Pig Butchering Scams: Guide to Crypto Romance Fraud

- Shareholders’ Disputes: How Business Valuation Helps with Shareholder Dispute Resolution

- 11 Costly Business Valuation Errors (And How to Avoid Them)

- Fraud in Divorce: How UK Experts Expose Hidden Assets