As business owners, understanding the many nuances of your firm’s financial health is paramount. With this in mind, getting to grips with the distinctions between loss of revenue vs loss of profits is far more than just accounting jargon — it’s actually the key to helping you make more informed decisions that can safeguard your company’s future.

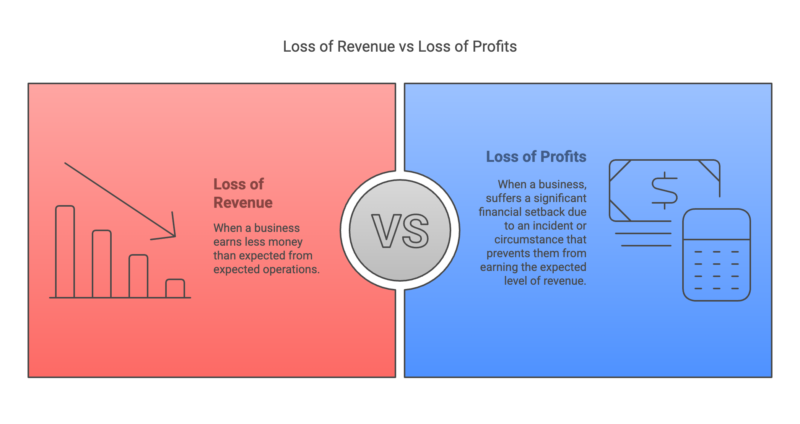

In business, loss of revenue and loss of profits can often feel like they’re used interchangeably. However, this is a major misconception as the two actually have very different meanings and possible implications for your firm.

Whether you’re facing market downturns, disruption to your operation, or rising costs, knowing how these losses can affect both your bottom and top line can be essential.

This blog aims to clarify the major differences between loss of revenue vs loss of profits, while exploring their significance in a number of business contexts. Lost profits, in particular, can have significant implications for businesses.

Loss of Revenue Meaning

Revenue represents the total amount of income generated by a business as a direct result of its normal day-to-day activities. This typically refers primarily to the sale of goods and services. A loss of revenue refers to any reduction in this standard operating income.

The reason for this loss of revenue can vary hugely between different businesses, industries, and regions. Often it will boil down to things like a decrease in sales (the reasons can be countless), periods of economic downturns, or disruptions to operations.

Revenue Loss Examples

As highlighted above, revenue lost stems from any reduction to the standard operating income. This can include examples such as:

- Declining Sales: Businesses can experience a drop in sales as a result of various factors, including increased competition, shifts in consumer behaviour, and more.

- Disruption: Issues such as a supply chain problems or a technical fault with electricity or other key utilities, could lead to a temporary shutdown of operations, leading to missed sales opportunities.

- Changes to the Market: It’s not uncommon for a business to find its popularity diminishes when a new competitor enters the market with an updated offering. This will likely lead to a reduction in revenue.

Understanding loss of revenue is the first step in identifying broader financial challenges, including lost profits.

Defining Loss of Profit

Whether talking about a global conglomerate of businesses, a car-boot sale, or a child’s lemonade stand, the definition of profit remains the same. Profit is what is left over once all expenses are deducted from revenue, this includes but is not limited to:

- Cost Of Goods Sold (COGS)

- Operating expenses

- Taxes

- Interest

Loss of profit will take place if there is ever any notable fluctuation to incomings or outgoings — by way of a decrease to revenue or an increase to costs — or potentially both.

Examples of Loss of Profit

Loss of profit will typically take place when a business, or individuals, suffer a significant financial setback due to an incident or circumstance that prevents them from earning the expected level of revenue. Below are some notable reasons for loss of profit:

- Increased Costs: If a business were to see its profit margins shrink as a result of things like rising cost of material or utilities, or an increase to wages (either optional or government-mandated) without a corresponding and relative increase to revenue.

- Fixed Costs During Interruptions: Companies that are forced to shut their doors for an extended period, thus leading to a significant reduction in revenue, will likely still have fixed costs. This can include rent and salaries.

- Operational Inefficiencies: Some form of operational inefficiency can strike virtually any business — often by surprise. Things such as wasteful or inefficient processes, or poor management of inventory/resources, will result in lower profit margins.

Key Differences Between Loss of Revenue and Loss of Profit

When discussing loss of revenue vs loss of profits, while both can have a significantly negative impact on the short, mid, and long-term success of a company, they will do this in different ways. While one will have an immediate and obvious impact, the other will see more of a sting down the line.

Key differences between loss of revenue vs loss of profits include the following:

Direct vs Indirect Impact

A loss of revenue will have a direct and immediate impact on the top line performance of a company. This is because it represents a reduction in the total amount of money that’s coming into a business — or the top line.

Loss of profits, however, affect the bottom line — the final net income after all expenses, showing the company’s true financial health.

As a result, in the immediate short-term, a loss of revenue will typically be seen as the more pressing issue of the two. This is because lost revenue will impact the day-to-day inflow of cash needed to cover all operating expenses to keep the doors open. Without sufficient revenue, a company will struggle to maintain operations, likely leading to imminent financial stress and closure.

Strategies of Mitigation

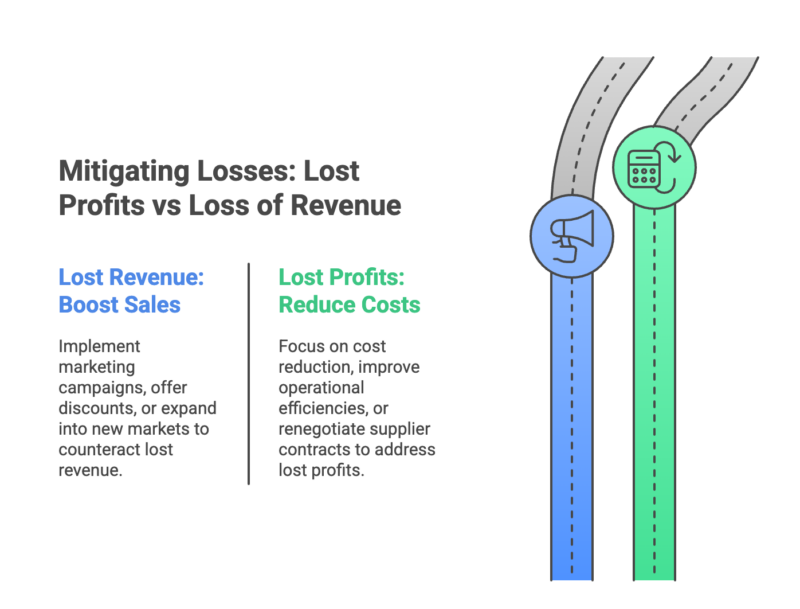

Loss of revenue vs loss of profit will likely have different methods of mitigation.

Lost revenue will often be countered by utilising methods aimed at boosting sales, including marketing campaigns, discounted goods, or expansion into new markets.

Meanwhile, reducing the impact of lost profits could involve attempting to reduce costs, improve your firm’s operational efficiencies, or renegotiate expenses such as supplier contracts.

Differing Impacts on Business Valuations

Loss of revenue can indicate things like reduced market demand or interest, which can potentially affect a company’s valuation, particularly if any decline observed is consistent across a significant period, or is severe enough.

On the other hand, loss of profits will directly impact valuation. This is because profitability is often seen as a major contributing factor when it comes to determining a business’s value. Prospective investors and stakeholders typically place larger emphasis on profit when assessing a company’s long-term viability.

The Importance of Differentiating Between Loss of Revenue and Lost Profits

Properly differentiating between loss of revenue vs loss of profits is vital, as they reflect totally different aspects of a business’s financial health. Therefore, each scenario requires distinct responses if you want to ensure the viability of your company. The circumstances in which understanding the difference is important include:

Legal Disputes

During periods of legal disputes, such as a breach of contract, the offended party may seek compensation for losses incurred. The specific type of loss — be it revenue or profit — will have a knock-on effect on the overall damage calculation process.

For example, a business may look to claim lost revenue to cover for sales opportunities missed, or lost profits as a result of cost increases associated with a breach or other dispute.

Financial Reporting

Accurate financial reporting is, naturally, essential if businesses want to comply with all accounting standards, as well as provide stakeholders (and potentially creditors) with a clear and honest picture of the firm’s financial health. Any losses of revenue or of profits should be included.

By misinterpreting these two metrics, a company director can, even accidentally, misinform key parties which, in turn, could leave the business and responsible individual in hot water.

Business Planning

For a business to be able to properly and thoroughly plan for the future, including preparing for future growth or recovery options, it must be able to differentiate between loss of revenue vs loss of profits.

Strategies catered to increasing revenue may not, by default, lead to an increase in profits, and vice-versa. Additionally, company directors focusing attention on the sole aim of cutting costs and increasing profit margins could have a knock-on effect on revenue generation if customers/consumers get wind of the changes and begin to feel disillusioned with your offering.

Investment Potential

As highlighted above, if you’re looking to make an investment, it is paramount that you fully understand the difference between loss of revenue vs loss of profits as it can be the difference between a profitable investment and a failure.

A potential investor into a struggling firm must be able to conduct an investigation to ascertain why it is facing difficulties. For example, a company with loss of profits due to some internal operational inefficiencies would likely be a more attractive option than one with a rapidly shrinking customer base affecting revenue.

Common Loss of Revenue vs Lost Profits Questions

Here are some frequently asked questions about loss of revenue, loss of profits, and their implications:

Q: What is the Difference Between Loss of Revenue and Lost Profits?

Loss of revenue refers to a reduction in total income generated by a business, often due to declining sales or operational disruptions. Lost profits, on the other hand, are the net financial losses after deducting expenses, reflecting the true impact on a company’s bottom line. Understanding both is crucial for accurate financial planning and decision-making.

Q: How do you Calculate Lost Profits?

To calculate lost profits, gather financial data such as revenue and expense records. Identify the loss period and compare it to a baseline, such as previous performance or industry benchmarks. Subtract the actual profits during the loss period from the expected profits to determine the lost profits. Consulting a forensic accountant can ensure accuracy.

Q: Can Lost Profits be Recovered?

Yes, lost profits can often be recovered through legal claims, such as breach of contract or negligence cases. Additionally, businesses can mitigate losses by reducing costs, improving operational efficiencies, or renegotiating supplier contracts. Proactive measures can also prevent future lost profits and safeguard financial health

Q: What Causes Loss of Revenue?

Loss of revenue can result from declining sales, economic downturns, or operational disruptions like supply chain issues. Increased competition, shifts in consumer behaviour, or technical failures can also lead to reduced income. Identifying the root cause is essential for implementing effective strategies to recover lost revenue.

Q: How Can Businesses Mitigate Loss of Revenue?

Businesses can mitigate loss of revenue by boosting sales through marketing campaigns, expanding into new markets, or offering discounts. Improving operational efficiency and addressing supply chain disruptions can also help. Regularly monitoring financial performance and market trends ensures timely action to prevent significant revenue loss.

Inquesta Forensic For Trusted Corporate Support

Navigating the complexities and differences between loss of revenue vs loss of profit can be confusing and potentially even daunting, particularly if the stakes are high. So, if your company is dealing with serious financial setbacks, understanding and being able to accurately calculate lost profits is crucial.

At Inquesta Forensic, we specialise in lost profit calculations, providing expert advice tailored specifically to your individual, unique situation.

When it comes to your business’s financial health and future, don’t leave anything to chance — get in touch with a member of our today to find out more about our varied range of services, and to learn about what our specialist, experienced support can do for you.

Disclaimer: This blog is for informational purposes only and does not constitute legal advice. Always consult with a professional for specific advice related to your situation.

- Cryptocurrency Valuation During Divorce When Bitcoin Crashes: The Impact of Timing and Volatility

- Your Partner’s Been Convicted: Can They Take Your House? What Section 10a POCA Means For You

- The Essential Role of Forensic Accounting in High Net Worth Divorce

- How to Value a Startup Business: A Guide for UK Entrepreneurs

- Pig Butchering Scams: Guide to Crypto Romance Fraud